Managing Healthcare Costs

Understanding Insurance

Health insurance is a legal agreement between the company and the covered individual to pay or reimburse some of your health care costs. This provides financial protection in case you become sick or injured, so you do not become responsible for 100% of the amount. It is generally divided into two main groups: public and private. Public insurance includes government programs such as Medicare, Medicaid, or the Veterans Health Administration. Private insurance includes insurance plans received from their employer, bought directly from the health insurance marketplace, or bought directly from the insurance company.

Types of Insurance Fees

Health insurance costs can be described by these five main terms:

- Premiums: The amount of money the individual pays for the health insurance plan. The individual or their employer makes this payment on a predetermined schedule regardless of how many services the individual uses. This payment does not count toward your deductible or out-of-pocket max.

- Deductibles: The out-of-pocket amount the covered individual must pay for covered health care services before the insurance plan begins to contribute.

- Copayment: A fixed amount that the covered individual will pay out of pocket for their health care cost, after meeting their deductible.

- Coinsurance: The percentage that the covered individual will pay out of pocket for a covered health care service after meeting the deductible.

- Out of Pocket Max: The maximum amount of money the covered individual will be required to pay before the health insurance begins to cover 100% of the health care costs for the remainder of the plan year. The deductible, copay, and coinsurance typically contribute to this amount.

Types of Health Insurance Plans

Within a healthcare insurance company, there are many types of insurance plans. Click below to see a quick summary of each type.

Health Maintenance Organization (HMO)- A plan provides a network of doctors and hospitals contracted with the insurance plan. This plan typically has lower premiums and higher deductibles and requires you to visit your primary care doctor and get a referral to see a specialist. This insurance plan typically will not cover out-of-network providers unless it is an emergency.

Preferred Provider Organization (PPO) – This plan allows you to see an in-network provider or out-of-network provider. This plan typically has a higher premium but does not require you to get a referral to receive care from a specialist. For out-of-network providers, you may have to pay out of pocket at the facility, however you can submit a claim directly with to the insurance company to request reimbursement for the cost.

Exclusive Provider Organization (EPO) – This is a plan that is similar to the HMO plans where they will only cover in-network providers, however, you may not need to receive a referral from your primary care provider to receive specialty care. Out of network care is not typically covered unless it is for an emergency service that is preapproved (Please note this may vary by plan)

Point of Service Plans (POS) – This insurance plan allows you to use in-network and out-of-network providers, however, you will pay a lower cost if you use an in-network provider. This plan does require a referral from your primary care physician and it may be harder to get services provided by out-of-network providers covered.

Medicare is a federal insurance program available to individuals ages 65 and older. Its coverage is divided into four parts: Part A, Part B, Part C, and Part D.

- Part A: Provides coverage for inpatient hospital care, skilled nursing facility care, home Health care, and hospice care.

- Part B: Provided coverage for outpatient medical care, durable medical equipment (DME), home health services, ambulance services, preventative services, therapy services, and mental health services, as well as select prescription drugs.

- Part C: This is also known as the “Medicare Advantage Plan.” It offers different types of Medicare plans, such as HMOs, PPOs, or private Fee-For-Service plans.

- Part D provides coverage for most outpatient prescription drugs. Private companies can offer this plan as a stand-alone or part of a package of benefits included with the Medicare Advantage Plan.

Medicaid is a joint state and federal insurance program that provides health insurance to some individuals with limited resources. The federal government provides rules that all state programs must cover, however each state runs its program. Because of this, eligibility and benefits can vary depending on the state. To learn more about Medicaid, visit Medicaid.gov

Children’s Health Insurance Program (CHIP) is a publically funded insurance program that provides medical insurance coverage to children through Medicaid programs as well as separate CHIP programs. It is a joint program, meaning the federal government sets the requirements, however, individual states run the program. Due to this, eligibility and coverage can vary based on the state of residence. To learn more about CHIP and how to apply, visit Medicaid.gov/CHIP

Understanding Hospital Bills

Going to the hospital can be stressful, and when you get the bill, it might feel even more confusing. This guide will help you understand hospital bills and show you ways to lower your costs.

How Hospital Billing Works

Privately owned and publicly owned hospitals typically accept private and public insurance plans. In most cases, insurance plans use a diagnostic-related group to assign the amount they will pay to the hospital to cover the cost of a specific treatment or condition based on the diagnosis code.

In an outpatient hospital setting, the ambulatory payment classification is the grouping system used to determine how much reimbursement the hospital will get for a specific procedure (typically used by Medicaid). This system classifies the level of reimbursement or the allowed amount based on a large amount of data that looks at the number of resources used and the similarity of previous cases. This classification is prompted using the Current Procedural Terminology (CPT) code. CPT codes are a way for a hospital or provider to describe (to the best of their ability) the type of service and resources the physician provided during the visit.

Physician fees are separate and can be an additional part of the cost related to a hospital stay. Physician fees are determined by the CPT code.

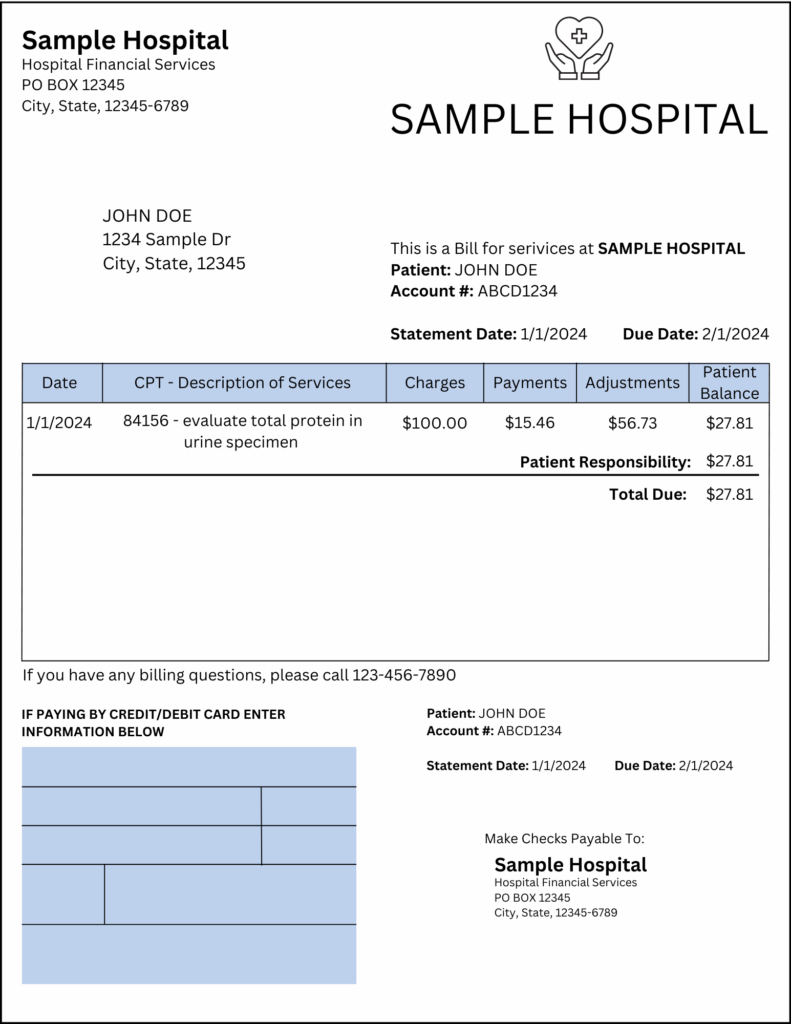

1. How to Read Your Bill

A hospital bill can be long and confusing, but here’s how to break it down:

- Account Summary – Shows the total amount owed.

- Date of Service – When you were treated at the hospital.

- List of Charges – A breakdown of what you’re being billed for and their CPT code.

- Insurance Adjustments – If the facility’s charge is higher than the maximum the insurance company will allow, the company will adjust the charge to its allowed amount.

- Payments – If your insurance contributes to the cost, it can be found on the bill

- Amount Due – The final amount you owe after insurance (or discounts).

- How To Pay – The bill will also include options for submitting payment and a number to contact if you have questions about your bill or want to discuss financing options.

Tip: If something looks wrong or costs too much, call the billing office and ask them to explain.

2. What’s in a Hospital Bill?

A hospital bill is like a receipt that shows what you were charged for during your visit. It may include:

- Doctor Fees – The cost of the doctors and nurses who helped you.

- Tests & Lab Work – Charges for X-rays, blood tests, or other medical tests.

- Medications – Any medicine you received while in the hospital.

- Room Fees – If you stayed overnight, you may be charged for a hospital bed.

- Medical Supplies – Things like bandages, IV fluids, or special equipment used during treatment.

Tip: Always ask for an itemized bill, which is a detailed list of all charges. This helps you check for mistakes!

3. How Do You Get Charged?

Hospitals charge patients in different ways depending on their insurance and financial situation.

If you have insurance:

- Your insurance company will pay part of the bill.

- You may have to pay the copay (a set amount) or deductible (the amount you pay before insurance helps).

If you don’t have insurance:

- You’ll get a bill for the full amount, but you can ask for financial help (see Section 4).

- Some hospitals offer charity care, which lowers or cancels your bill if you qualify.

4. What to Do If You Can’t Afford the Bill

If your hospital bill is too high, you have options!

1. Ask for a Payment Plan – Many hospitals let you pay in small amounts over time instead of all at once.

2. Apply for Financial Assistance – Nonprofit hospitals must offer charity care or discounts for low-income patients.

3. Negotiate Your Bill – You can ask the hospital to lower your bill.

4. Check for Billing Errors – Hospitals sometimes charge for things by mistake. Always double-check your bill!

Tip: Many hospitals have a Patient Advocate or Billing Department to help you understand your options.

5. How to Avoid Surprise Bills

Know Before You Go – If it’s not an emergency, call the hospital or your doctor to ask how much a visit will cost.

Ask If the Doctor Is “In-Network” – Some doctors charge more if they don’t work with your insurance.

Get Everything in Writing – If the hospital promises a discount or payment plan, ask for proof in writing.

6. Who to Call for Help

If you need help understanding or lowering your hospital bill, you can reach out to:

- 📞 Hospital Billing Office – Ask about payment plans or discounts.

- 📞 Your Insurance Company – Make sure they paid everything they were supposed to.

- 📞 A Medical Bill Advocate – A professional who can help lower your bill (some work for free!).

- 📞 Government Help Programs – Check if you qualify for Medicaid or other financial aid.

- Find local help here: Healthcare.gov

Note

A healthcare facility can submit a bill insurance claim for an amount higher than the insurance company’s allowed amount. However, if you use an in-network provider, the facility must “write off” the amount above the allowed amount (once it is confirmed by the insurance company), typically called an adjustment. Your insurance plan determines the amount allowed.

Know Your Healthcare & Legal Rights as a Patient

Understanding your rights as a patient can help you make informed decisions, avoid unnecessary costs, and ensure you receive fair treatment. Below is a simple guide to your rights and key resources.

How to Protect Yourself

- Keep copies of medical records and bills

- Ask for written explanations of costs and treatments

- Know the nearest free or low-cost clinics

- Learn your state-specific patient rights

The Right To Emergency Treatment

- Under the Emergency Medical Treatment and Labor Act (EMTALA), hospitals must provide emergency care regardless of your ability to pay or insurance status.

- You cannot be turned away for lack of insurance in a true emergency.

The Right To Informed Consent

- Before receiving treatment, you have the right to know and understand your medical condition, treatment options, risks, and alternatives.

- You can refuse treatment if you choose (except in life-threatening cases where you are unconscious or incapacitated).

The Right To Privacy

- Your medical information must be kept private under the Health Insurance Portability and Accountability Act (HIPAA).

- You have the right to view, request, and (in some cases) amend your medical records.

The Right To Cost Transparency

- You have the right to request an itemized bill and question any unexpected charges.

- Nonprofit hospitals must provide financial assistance or charity care if you qualify.

The Right To Appeal Insurance Decisions

- If your insurance denies coverage for a service, you have the right to appeal the decision.

- The insurance company must provide a reason for denial and steps to dispute it.

The Right To A Second Opinion

- You can seek a second opinion from another doctor before making major medical decisions.

- Some insurance plans may even cover second opinions.

The Right To File A Complaint

- If you believe your rights were violated, you can file a complaint with government agencies:

- Medical Mistreatment: State Medical Boards

- HIPAA Violations: HHS Office for Civil Rights

- Insurance Issues: State Insurance Departments